The live and feeder cattle futures markets experienced sharp downward price behaviour during the final quarter of 2024. Although the price weakness was being influenced by the nearby fundamentals, the deferred live and feeder cattle contracts were also trending lower. In this article, I’m going to discuss market behaviour referred to as the “constellation of prices.”

The constellation of prices is when the deferred live cattle futures behave and move in tandem with the nearby contract. There is a difference between this behaviour in the cattle and grain/oilseed markets because cattle are theoretically non-storable. Understanding this behaviour can be extremely valuable when deciding to forward price fed cattle. It’s also valuable for backgrounders and cow-calf producers when buying price insurance.

In the grain/oilseed futures markets, the price spread between the nearby contract and the deferred contract is largely determined by storage and interest costs. When the nearby contract expires, the function of the next contract month is to move to where the previous month expired. This is often referred to as the collapse of the carrying charge. Traders will often say the carrying charge is coming out of the market. A wider spread between the nearby and the deferred months is reflected by a wider basis. In theory, a spread should not be wider than the full cost of storage and interest, but it does happen on occasion. A wider basis is viewed as bearish in the grain markets. This is con- fusing for many farmers. When the deferred contract is higher, farmers think the market should strengthen but it actually signals the reverse. The market is telling the farmer to sell now for deferred delivery. The market does not want your product now but later.

Read Also

Cattle Market Summary

Break-evens, cow and calf prices, plus market summaries courtesy of Canfax and Beef Farmers of Ontario. Cost of Production October…

In contrast, a narrower spread between the nearby month and the deferred month in the grain/oilseed markets results in a stronger basis level. A narrow basis is typically viewed as a bullish signal for the futures market. In the grain and oilseed markets, when the nearby contract is premium to the deferred, the market is telling the farmer to sell now for immediate delivery instead of storing the crop.

The fed and feeder futures contracts are unique because cattle are theoretically non-storable. Fed cattle can be held for a certain amount of time but eventually must move to market. Feeder cattle can be held for a longer period, and this is referred to as semi-storable. For example, a 500-pound calf can be held until it is 700 or 800 pounds if the owner chooses.

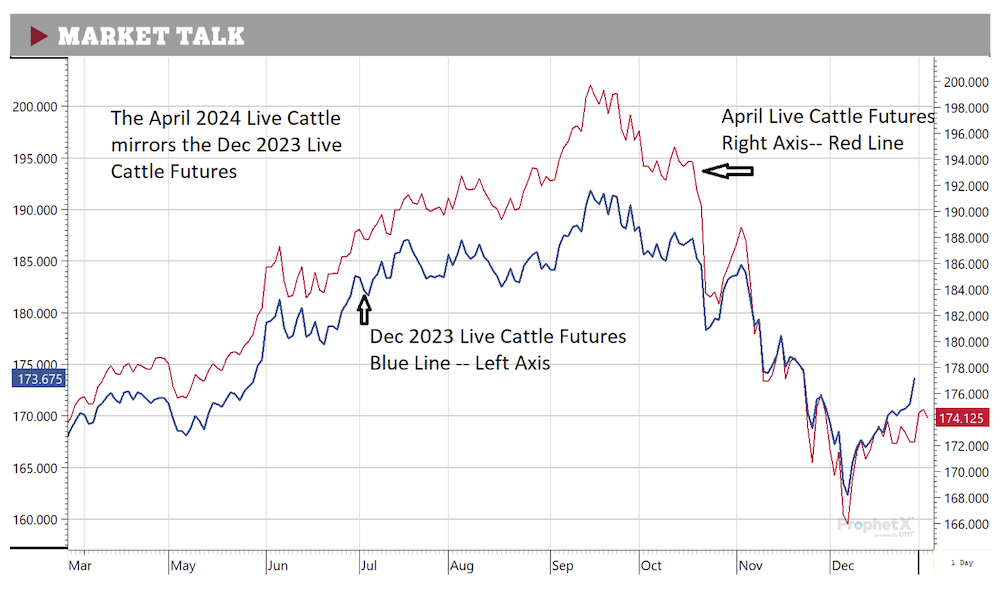

In this article, I’m going to refer to the chart below showing the December 2023 live cattle futures and the April 2024 live cattle futures. The supply and demand during the final quarter of 2023 were significantly different from the supply and demand for the first quarter of 2024. However, when the December 2023 live cattle futures started to trend lower in late September, the April 2024 live cattle contract moved in tandem with the December contract. Producers who had fed cattle that would be market-ready in January, February and March 2024 were confused by the price behaviour. I received calls asking why the April 2024 contract was trading in tandem with the nearby October and December contracts. Shouldn’t prices be higher later in the spring compared to the fall of 2023? This is where the misunderstanding comes into play.

The nearby live cattle contract is price discovery for the overall live cattle complex. The spread between the December and the April live cattle futures reflects how the supply and demand changes between the two time periods.

For example, U.S. GDP during the third quarter of 2023 was 5.2 per cent (quarter- over-quarter seasonally adjusted annual rate). U.S. GDP for the fourth quarter of 2023 was only expected to be two per cent and first quarter GDP was expected to fall to 1.5 per cent. Strong demand in the third quarter was actually lifting the deferred months to the higher levels. Notice the December 2023 and April 2024 live cattle contracts made their highs at the same time. The fed cattle supplies were expected to be tighter in April compared to December, thus the April 2024 live cattle futures were trading at a $5-$8 premium over the December 2023 live cattle contract. The rally in late summer of 2023 was very much a demand feature. As demand started to fade, the overall complex started to trend lower.

Given this knowledge, it was prudent to be more aggressive in forward contracting for the fourth quarter of 2023 and the first quarter of 2024. Of course, the live cattle are the feeder cattle futures five months forward. Backgrounders and cow-calf producers need to watch the live cattle for the timing of purchasing their price insurance or forward contracting their calves and yearlings.