Cattle prices across North America are signaling cow-calf producers to expand. How producers respond to that signal can be limited by weather and future market expectations. The January 1, 2014 cattle inventory reports showed stabilization in the U.S. industry as improved pasture conditions and feed supplies have halted the liquidation. North of the border inventories were down slightly, which is not unexpected in the consolidation phase.

Canadian Inventories — no growth in sight!

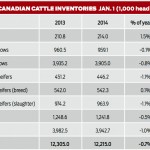

Total cattle inventories on January 1 were down 0.7 per cent at 12.2 million head. Beef cows, dairy heifers, beef heifers for slaughter and calves were all down around one per cent. Beef cow inventories were down 0.8 per cent at 3.9 million head. This wasn’t surprising given the much larger cow marketings in 2013. The largest declines were seen in Manitoba (-5.5 per cent) and Quebec (-2.7 per cent). This was followed by relatively steady numbers in the Atlantic provinces (-0.5 per cent), Alberta (-0.3 per cent), Saskatchewan (+0.2 per cent), British Columbia (+0.4 per cent) and a slight increase in Ontario (+1.1 per cent).

The 2013 calf crop was down one per cent or 40,000 head; however, much larger feeder exports last fall and this spring will leave fed cattle marketings decidedly tight in 2014. Alberta and Saskatchewan cattle-on-feed numbers were 10 per cent higher on March 1 compared to last year. This occurred for a number of reasons (1) a larger number of calves came to market last fall; (2) an attractive replacement ratio encouraged feedlots to sell fed cattle at lighter weights in the first quarter; and (3) the ability to lock in profitable margins made it attractive to place feeders even at higher prices. These large cattle-on-feed numbers are expected to decline as we move into summer, as fewer placements are available out in the country. The yearling market will be extremely interesting this year as fed marketings are looking to be much smaller by the fourth quarter.

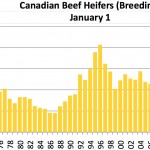

After three years of modest beef heifer retention, bred heifer inventories this year remained generally static at 542,300 head. Beef heifer retention remains well below the 20-year average of 633,000 head. This is a soft number and a lot can change between January and when the bulls get turned out. Higher feeder prices are well above the highs seen in the first part of 2012 and will encourage heifer retention.

The Canadian cattle industry is now in the third year of the consolidation phase. Historically this phase has lasted around two to three years before expansion begins. Due to many market factors it was expected that this consolidation phase could be longer, as much as four to five years. Feeder prices are definitely signalling cow-calf producers that now is the time to expand.

U.S. herd is stable

The USDA reported total cattle inventories on January 1 at 87.7 million head, down 1.8 per cent or 1.56 million head. Inventories have been declining since 2007 and are now 8.84 million head below the 2007 peak. Beef cow inventories were down 0.9 per cent or 255,000 head at 29 million head. The beef herd has declined in 16 out of the last 18 years as productivity improvements (from higher replacement ratios and carcass weights) mean fewer cows are needed to produce the same or more beef. While dry conditions and high feed costs in the first half of 2013 encouraged liquidation, improved pasture and lower feed costs in the second half encouraged producers to stabilize the herd in many regions. The belief that the herd would be able to go into full expansion mode within six months of improved pasture conditions was perhaps overly optimistic.

Pre-report estimates were expecting beef replacement heifers to be up three per cent; USDA reported them up a modest 1.7 per cent at 5.47 million head. Breeding heifer numbers have been steadily increasing from a low of 5.1 million head in 2011. However, they are still below the recent high of 5.86 million head seen in 2006, which was the last time beef inventories increased. To get back to 2006 levels, breeding heifer numbers would need to increase by a staggering seven per cent. Even with current record high prices and lower feed costs this is unlikely to happen in 2014. Partly because there continues to be uncertain moisture in the states where there is room for the U.S. beef herd to grow. In order for the reported larger heifer numbers to be kept on farms, more consistent rainfall will be needed in some regions this spring and summer.

Read Also

Where is the top of the fed cattle market?

In late April, Alberta packers were buying fed cattle on a dressed basis at $486/cwt delivered, up about $30/cwt from…

Without the July 1 inventory survey this is the first look we have of the 2013 calf crop, which is down one per cent or 349,000 head at 33.9 million head. Cattle-on-feed numbers were extremely tight in the first quarter but are expected to increase moving into the summer. While placements this spring will increase supplies this summer, possibly higher than last year, they will not be historically large. Placing cattle now, means they cannot be placed in the future. This means placements this summer will likely be small again, leaving another hole in supplies in the first quarter next year.

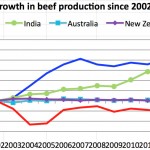

Global Inventories Steady

Global cattle inventories in 2014 are up only 2.4 per cent from 2008, with all of that growth coming from the Indian dairy herd. Other countries have contracted or stabilized. Global beef production is projected to be steady in 2014; while Asian demand continues to grow, albeit at a slower pace than what was seen in 2013. The medium-term outlook is for grain prices to be lower over the next three to five years with replenished ending stocks. Meanwhile, strong demand will continue to support beef prices. This should encourage beef production from all major producing and exporting countries. The question is: Who will respond the most and the fastest?

Australia had exceptionally dry conditions in the northern part of the continent in 2013, which forced liquidation. Beef production is forecast to decline in 2014 despite improved moisture conditions, although some regions remain dry. Moving forward, strong demand from the rapidly growing Asian market could attract production that would have historically been exported to the U.S. New Zealand and India have dairy-driven production and provide lean manufacturing beef. Both countries are currently focused on exporting to China.

Beef Cow Culling Rates

Cow marketings were up an astounding 22 per cent in 2013 with domestic slaughter up nine per cent and exports up 55 per cent. Marketings were supported by cows being shifted from the fourth quarter of 2012, when the Brooks plant was temporarily closed and cow prices dropped, into the first quarter of 2013. Marketings also increased in the fourth quarter fueled by disappointing calf prices and in spite of lower feed costs. Larger marketings pushed the beef cow culling rate up to 14.3 per cent. This is well above the long term average of 11 per cent and the 2012 rate of 10 per cent.

In the first quarter of 2014, cow slaughter was down a modest 5 per cent from 2013 and down 7 per cent from the three-year average. Cow exports remain large, up three per cent from a year ago. This is not indicative of an industry that is ready to jump into expansion, but one that is taking a more cautious approach.

Alberta cow prices were discounted by $6.52/cwt to the U.S. in 2013. This widened in November and December to around $15/cwt encouraging live exports. The spread continued to widen to $17/cwt in the first quarter of 2014 as U.S. cow prices jumped in response to the strong trim market, smaller cow slaughter and limited increase in non-NAFTA imports. The trim market is expected to stay hot throughout 2014, as non-NAFTA countries have multiple options on where to sell their product and North America struggles to expand. Consequently, cow prices are anticipated to make a new record high this year surpassing the $76/cwt average in 2013.

Record-high cattle prices!

The year started off with a bang and record-high cattle prices for all classes of cattle. Cattle prices were helped by an exchange rate that moved lower in January. Alberta fed cattle prices averaged $136-$137/cwt in the first quarter of 2014 taking fed prices to a whole new level. By August 2013, yearling prices had surpassed 2012 ($142/cwt) and 2001 ($139/cwt) highs. Prices only moved higher since then with Alberta 800- to 900-lb. steers averaging $167/cwt and 500- to 600-lb. steers averaged $209.50/cwt in March, surpassing the previous 2012 ($183/cwt) and 2001 ($169/cwt) highs.

Higher cattle prices combined with lower input costs is a recipe for dramatically improved margins. For the first time since January 2012 feeding margins (based on a cash price) were profitable in February and March 2014. Lower feed prices reduced break-evens for feedlots on calves expected to be marketed in May through September. However, feeder cattle prices have moved up so much over the past three months that break-evens moving into the fall will be steady to higher than last year, according to the Canfax Trends program. Yearlings marketed from March through May have lower break-evens, but yearlings placed against August delivery are projected to have break-evens 7.7 per cent higher than last year. Despite the move back to higher break-evens, 2014 is shaping up to be a good year for the cattle feeder with opportunities to hedge a profit.

Trade was Up!

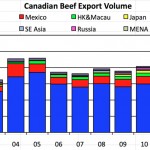

Beef exports were up three per cent in volume and 10 per cent in value at 279,300 tonnes valued at $1.3 billion. The small increase in export volumes occurred despite smaller production. A lower Canadian dollar increased export values in 2013, and will continue to do so in 2014. Exports (including live slaughter cattle) as a proportion of beef production was up slightly at 44 per cent in 2013. Over the last decade this has ranged between 39-51 per cent with an average of 45 per cent, putting 2013 just below the 10-year average.

• Exports to the U.S. were up two per cent in volume and five per cent in value at 199,000 tonnes valued at $907.7 million. Reliance on the U.S. market has been decreasing over the last couple of years as demand strengthens in Asia. The U.S. represents 71 per cent of total exports down from 75 per cent just two years ago.

• Exports to Hong Kong and Macau had been stable from 2010-12 around 21,000 tonnes but broke through that in a big way in 2013 to be up 31 per cent in volume and 95 per cent in value at 28,000 tonnes valued at $178 million. Hong Kong moved up to be Canada’s second-largest market in 2013 representing 10 per cent of total exports.

• Exports to Mexico were down 26 per cent in volume and 22 per cent in value at 18,500 tonnes valued at $96.8 million. Mexico dropped to be Canada’s third-largest market in 2013 representing 6.6 per cent of total exports. The significant decline in Canadian exports to Mexico since 2010 have been due to currency changes, larger domestic production of muscle cuts that compete with imported product and reduced per capita beef consumption as consumers move towards cheaper pork and poultry. Mexican beef imports have dropped by 55 per cent over the last decade.

• Exports to Japan were up 19 per cent in volume and two per cent in value at 14,400 tonnes valued at $70 million. Representing 5.2 per cent of total exports, volumes to Japan have been steadily growing and benefited from under-30-month access in February 2013. Further growth is anticipated in 2014.

• Exports to mainland China also took off in 2013 reaching 6,000 tonnes valued at $25 million, up from 1,500 tonnes valued at $5.4 million in 2012. Chinese beef imports skyrocketed in 2013.

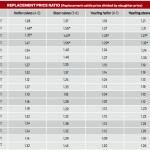

Replacement Ratios

Replacement ratios show how much higher feeder cattle prices are per pound of fed cattle. The lower the ratio the fewer dollars a feedlot needs to replace an animal. Conversely, a high ratio implies the feedlot must pay more per pound to replace an animal. Consequently, a higher ratio has negative implications on feedlot profitability, if feed costs are constant. The ratio does not take into account changes in feed costs, which have a significant impact on a feedlot’s willingness to pay for feeder cattle. Lethbridge barley prices in March were down 37 per cent from last year and down 21 per cent from March 2012.

In the first quarter of 2014, replacement ratios were higher in the West compared to last fall, but lower in the East. In the West steer calves were 1.45, still below the first half of 2012 when it was 1.56. Yearling steers in the West were 1.26, also below ratios in early 2012. In the East, steer calves fell to 1.29 and yearling steers fell to 1.16.