Southern Alberta barley prices have been percolating higher over the last month. Feedlots in the Lethbridge area were buying feed barley at $215/mt delivered in mid-July, which is up approximately $40/mt from a month earlier. Feed wheat prices have also rallied in correlation with the milling wheat market so that southern Alberta feed wheat bids now range from $210/mt to $220/mt delivered. Most feedlot operators were caught off guard with this recent rally; feeder cattle input costs have risen by $35 to $50 per head, depending on the weight category. I’ve received many calls from feedlot operators and backgrounding farmers regarding the price outlook for feed barley. Therefore, I thought this would be an opportune time to review the fundamental structure given the recent developments.

Read Also

Feed grain update for Canadian beef producers

Factors affecting the feed grain market and what it means for Canadian cattle feeders

Statistics Canada’s survey showed that farmers seeded 5.8 million acres of barley this spring, down from 6.4 million acres last year. Using a 10-year average yield of 60 bushels per acre, the crop size has potential to finish near 6.7 million mt, which is down from the 2016 crop of 8.8 million mt and down from the 10-year average production of 9.5 million mt. The barley market is contending with an extremely tight supply situation for the 2017-18 crop year so that the function of the market is to ration demand. Actually, the market has two functions: to secure domestic usage and also encourage the use of alternate feed grains.

The domestic barley market will have to trade at a premium to world values to secure domestic usage requirements. Currently, Canadian export offers are at a sharp premium to French and Black Sea feed barley prices. However, if we see strength in the world market, Canadian domestic prices will need to maintain a sharp premium to curb offshore movement. There are a few problem areas in the world that need to be watched. Australia is on the verge of a major drought. After a record barley crop last year, the current crop size could drop in half from year-ago levels. Ukraine has also received less than 50 per cent of normal precipitation over 50 per cent of the major growing area. The southern half of Europe has also experienced severe yield deterioration due to drier conditions earlier in spring.

The domestic barley market will also have to trade at a premium to alternate feed grains such as feed wheat. At this time, approximately 80 per cent of the Canadian wheat crop will grade in the top two milling categories. The burdensome feed wheat situation that was evident in the 2016-17 crop year will not continue. Feed wheat stocks will be rather snug for 2017-18. Therefore, the barley market is becoming more correlated with the Minneapolis wheat futures, which have been on fire of late.

The Alberta barley market may also trade at a premium to imported values of U.S. corn and DDGS. The corn futures market has incorporated a risk premium due to the uncertainty in production and this has spilled over into the domestic barley market. The corn market will be extremely sensitive to further weather developments due to the year-over-year decline in U.S. acreage. The slightest yield drag off of trend makes the fundamentals quite tight. This has made the Lethbridge barley price highly correlated with corn.

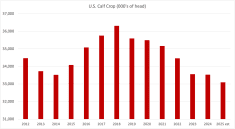

I’m forecasting a barley carry-out of 1.1 million mt for the 2017-18 crop year, which is down from the 2016-17 ending stocks of 2.1 million mt and down from the 10-year average of 1.9 million mt. Cow-calf operators need to be aware that the feeder market will have to absorb an additional $50 of input costs on an 800-pound steer. Feedlot margins have been in positive territory throughout the first half of 2017 but we may see negative margins in the final quarter. This will put the feeder market on the defensive late in the year and over the winter. Therefore, cow-calf producers should strive to sell their feeders sooner in fall, rather than later in winter. The barley market tends to experience some pressure at harvest but feedlot operators will want to book about 50 per cent of their winter requirements as a hedge against rising prices.