Canadian and U.S. fed cattle markets have been trading near or at historical highs during the summer. I’ve received many calls from cattle producers inquiring about the fed cattle outlook for the fall of 2024.

Everyone remembers that during the fall of 2023, the live cattle futures dropped about $30 from September through mid-November. While the fed market was under pressure, the feeder market also softened during October and November 2023. The fed and feeder cattle markets can be quite volatile. While U.S. calf crops have been shrinking on both sides of the border this doesn’t guarantee the market will continue to trade at historical highs.

In this article, I will provide an overview of the total beef supply situation taking into account U.S. imports and exports. Cattle producers will have a good idea of the beef supply situation when accounting for production along with the net trade. There is a major difference between the fall of 2023 and 2024 when analyzing the beef supply fundamentals. This could have a profound influence on the price structure for fed and feeder cattle. Remember, beef demand is inelastic so a small change in supply has a larger influence on the price.

Read Also

The Canadian Cattle Association’s international advocacy efforts

Global ag policies affect Canadian food policy, so the Canadian Cattle Association participates in international and domestic forums

On April 1, 2024, U.S. cattle on feed 150 days or more were up 21 per cent from last year. In addition to the larger on-feed number, carcass weights were three per cent to four per cent above year-ago levels. U.S. second-quarter beef production for 2024 will likely finish at 6.775 billion pounds, up 65 million pounds from the second quarter of 2023. The U.S. steer and heifer slaughter during the second quarter has been running above year-ago levels, causing market-ready fed cattle supplies to decline. However, as of July 1, 2024, market-ready supplies of U.S. steers and heifers were up an estimated 133,000 head from July 1, 2023. There was no shortage of fed cattle heading into the third quarter of 2023. Carcass weights continued to run two per cent to three per cent above last year.

U.S. third-quarter beef production for 2024 is projected to finish at 6.640 billion pounds, up 19 million pounds from the third quarter of 2023. The transition in the supply situation occurs during August. There are two major factors to consider. First, U.S. feeder cattle placements during the first four months of 2024 were down 310,000 head from 2023. Second, the year-over-year increase in the steer and heifer slaughter during July and August will drain the surplus of fed cattle. By the end of August, the U.S. will be in a fed cattle deficit. Market-ready fed cattle supplies will be rather snug during September.

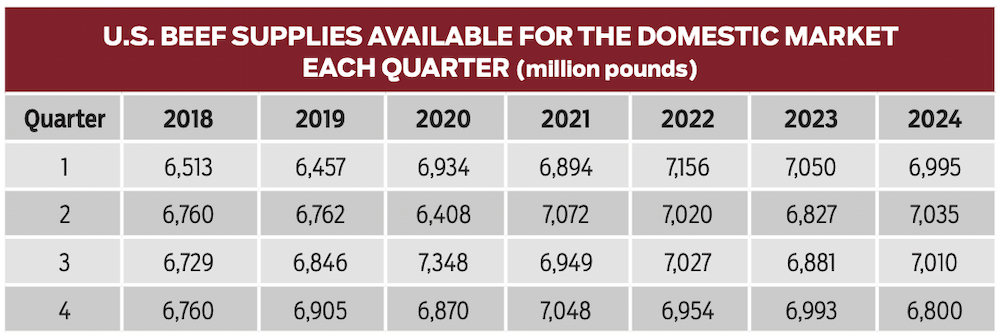

U.S. fourth-quarter beef production for 2024 is expected to finish at 6.615 billion pounds, down nearly 200 million pounds from the fourth quarter of 2023. I want to take this a step further and account for U.S. imports and exports of beef. Many analysts will project beef supplies available for the domestic U.S. market for each quarter. Beef production is only one contributor to the total supply available. We have to take into account imports and exports and stocks carried from one quarter to the next.

Beef supplies available for the domestic market are calculated by adding carry-in stocks plus production plus imports. This is the total supply. From this number, we subtract exports and carryout stocks. The net result is the beef supplies available for the domestic market.

I want to draw attention to the quarter-over-quarter change between the third and fourth quarters of 2023, and 2024. Notice during 2023, beef supplies available for the domestic market were larger in the fourth quarter compared to the third quarter. In 2024, supplies in the fourth quarter will be down from the third quarter. In 2023, the quarter-over-quarter increase in supplies contributed to the downward slide in the market from September through November. For 2024, there is a tightening supply situation due to lower imports and a year-over-year decrease in quarter beef production.

The fed cattle market and the live cattle futures are expected to trade in a sideways pattern during the fall period due to the quarter-over-quarter decrease in available beef supplies. The lower beef supplies will offset the seasonal softness in beef consumption. A firm fed market will keep the feeder complex well-supported.