In the September 6, 2022 issue of Canadian Cattlemen, I wrote an article stating that fed cattle numbers were expected to be extremely tight in the first half of 2023. I included a chart projecting that the feeder cattle futures would reach historical highs in October and November of 2023. Over the past couple of months, I’ve received many inquiries from cow-calf producers and feedlot operators regarding the outlook for feeder cattle now that the futures market has reached the upside objective. When prices of any commodity are at historical highs, the market functions to encourage expansion. In this article, I’ll discuss a few market indicators to watch over the next six to eight months.

When the feeder market encourages expansion, there is usually a year-over-year decline in the heifer and beef cow slaughter. Cow-calf producers hold back on heifers and reduce cow liquidation. Currently, the U.S. year-to-date heifer slaughter is running very similar to last year while the beef cow slaughter is only marginally below year-ago levels. Keep in mind that pasture conditions are favourable in the main grazing states such as Texas, Oklahoma, Colorado and Kansas. Looking at history, it takes one full year of historically high prices before a significant decline in beef cow slaughter occurs. I’m only expecting a sharp drop in beef cow slaughter in 2024. Heifer retention is expected to increase during the fall of 2023, but the market will only realize a sizeable decrease in the heifer slaughter in 2024.

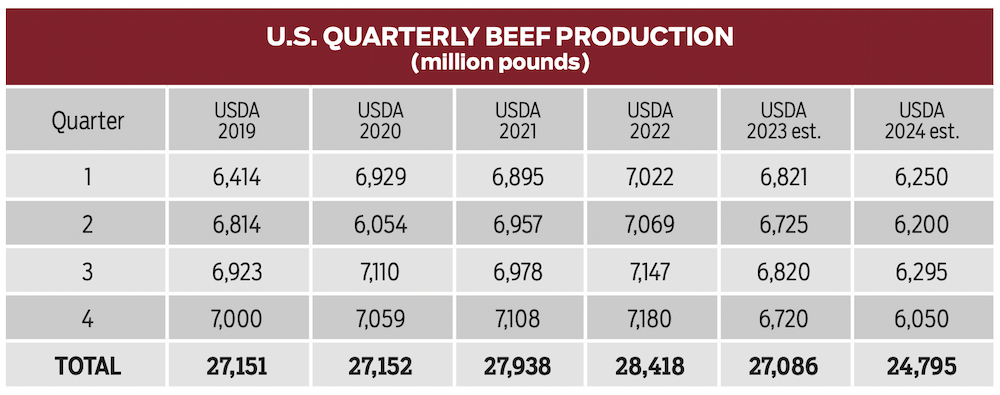

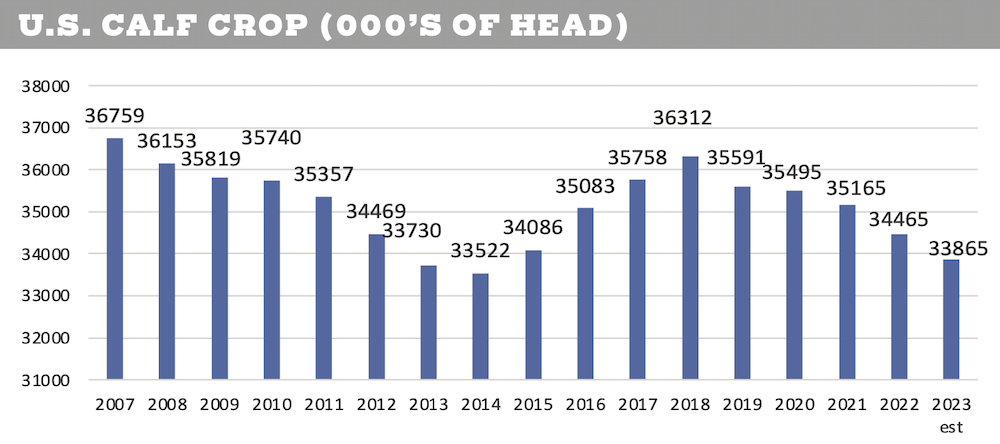

The U.S. cattle herd has been contracting since 2019. The contraction cycle will end in 2023 and the first year-over-year increase in calf crop will come in 2024. This will result in lower feedlot placements, lower fed cattle marketings and result in a sharp year-over-year decrease in beef production. When you look at the big picture, U.S. beef production for the 2024 calendar year is projected to finish near 24.795 billion pounds, down nearly 2.3 billion pounds from the 2023 output. The U.S. calf crop has been declining since 2019 but beef production has been increasing. That’s just how the cattle/beef production cycle works for the first segment of the contraction phase.

I conducted a straw poll of cow-calf producers in Alberta asking at what price would you consider expanding the herd. Alberta is the key province because 40 to 45 per cent of Canadian calves are born in Alberta. Some producers stated that $400/cwt for a 500-pound steer was needed to encourage expansion. Other producers stated they would only consider expanding at a price of $450/cwt for a 500-pound steer. At the time of writing this article, 500-pound steers were trading around $400. It’s important to note that in June of 2015, the highest prices for 500- to 600-pound steers in Western Canada were $340-$360/cwt. This goes along with an observation of historical cattle prices.

Read Also

Factors influencing cattle feeder market during the fall of 2025

Market analyst Jerry Klassen weighs in on live cattle markets

I’ve attached a chart of the live cattle futures. The arrows on the chart point to the time when the expansionary period in the cattle cycle started. Notice the old highs are no longer sufficient to encourage expansion. Looking at history, the market needs to move to fresh historical highs above the previous highs so the cow-calf producer expands the herd. This is logical. The family income from 2015 cannot support a family 10 years later.

In conclusion, we’ll only see a sharp drop in the U.S. beef cow and heifer slaughter in 2024. Looking at history, the old highs are no longer sufficient to encourage expansion. The market needs to move significantly higher than the previous historical high in 2015 to encourage expansion. The other half of the equation is at historical highs, markets ration demand. Prices move high enough so buyers back away from the market. Notice on the chart, there is always a significant pullback after the fresh historical highs. This half of the story is for a later article.