Since Alberta barley prices made seasonal lows in September 2024, the market has been percolating higher. In early September, Lethbridge feedlots were buying feed barley for $255-$260/tonne delivered. In late December 2024, Lethbridge feedlots were buying barley for as high as $315/tonne for spot delivery. The 10-year average barley price delivered Lethbridge is around $270/tonne.

As a rule of thumb, when the barley carryout is below the 10-year average, prices have to trade sharply above the 10-year average. During the 2024/25 crop year, the barley market rationed demand due to tighter ending stocks. Domestic barley prices need to trade high enough to encourage U.S. corn imports. The domestic barley market also needs to be premium to world values to curb export movement. Finally, the Lethbridge feed price needs to trade high enough so producers with malting barley sell into domestic feed channels.

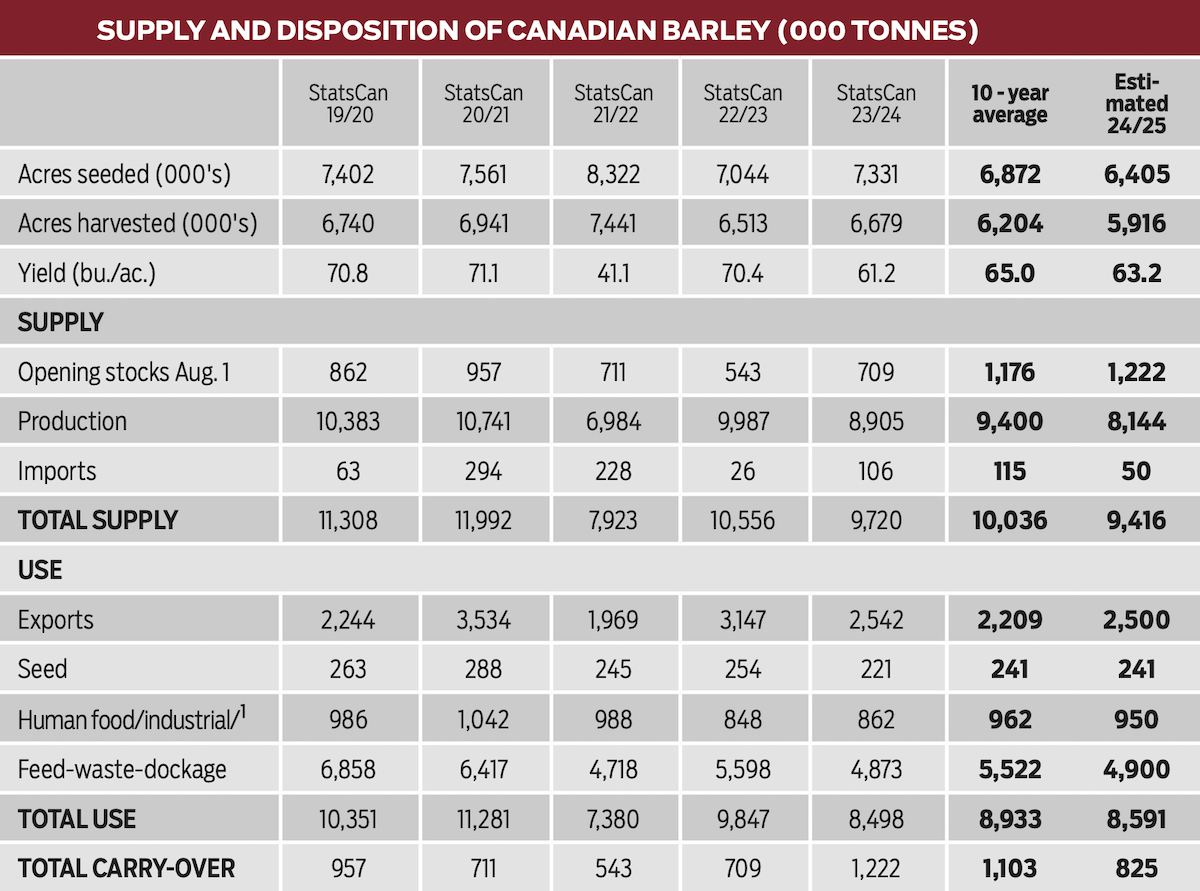

Statistics Canada’s final crop survey had the 2024 barley crop at 8.1 million tonnes. This was down from the 2023 output of 8.9 million tonnes and down from the 10-year average crop size of 9.4 million tonnes. We’re projecting the 2024/25 exports to reach 2.5 million tonnes. Domestic seed, food and industrial processing is expected to be similar to the 10-year average. This leaves about 4.9 million tonnes of barley for domestic feed usage, which is similar to the 2023/24 feed usage number but down from the 10-year average of 5.5 million tonnes. The 2024/25 ending stocks projection is 825,000 tonnes, down from the 2023/24 carryout of 1.2 million tonnes and down from the 10-year average of 1.1 million tonnes. The carryout will finish below the 10-year average.

Read Also

U.S beef industry faces demand risks and disease dangers

High beef prices and New World screwworm threaten beef demand and cattle health in the U.S.

At the time of writing this article at the end of December, French feed barley was quoted in the range of US$225-US$230/tonne freight-on-board (f.o.b.) Rouen. German feed barley was valued at US$226/tonne f.o.b. Hamburg. Australian barley was offered at US$230/tonne f.o.b. Port Adelaide, South Australia. Russian and Ukrainian barley was quoted at US$215-US$220/tonne f.o.b. Black Sea port. Canadian feed barley was offered in the range of US$245-US$250/tonne f.o.b. the West Coast. Canadian barley offers are maintaining a premium over Australian and European values which is tempering fresh export business. Canadian crop year-to-date exports for the week ending December 15 were 921,800 tonnes, up from the year-ago exports of 790,600 tonnes.

On the domestic front, wheat prices and imported U.S. corn prices are trending higher. Wheat for feed usage was trading in the range of C$300-C$315/tonne delivered in central and southern Alberta. The average elevator bid for No. 1 and No. 2 Canadian Western Red Spring (CWRS) wheat at 13 per cent protein was $308/tonne. Current prices are encouraging farmers to sell milling wheat into feed channels. Later in spring, we’re expecting a major rally in the wheat market which will reverse the current price structure. Farmers with milling wheat will sell to the elevators sourcing for offshore movement.

The weaker Canadian dollar has enhanced offers for U.S. corn, which are in the range of $310-$320/tonne delivered southern Alberta in late December. We are projecting U.S. corn imports into Western Canada for the 2024/25 crop year to reach 3.2-3.5 million tonnes, up from 2023/24 imports of 2.7 million tonnes. The Lethbridge barley market needs to trade at a $15-$20 premium to imported U.S. corn prices.

The world corn fundamentals are relatively snug despite the year-over-year increase in production in Brazil, Argentina and the U.S. Ending stocks from the major exporters (Argentina, Brazil, Russia, South Africa, Ukraine, excluding the U.S.) are expected to drop to eight million tonnes, down from the 2023/24 carryout of 9.75 million tonnes, and down from the five-year average of 14 million tonnes. The market cannot afford a crop problem in the Northern Hemisphere in the spring and summer of 2025. We’re expecting the corn futures market to incorporate a major risk premium from March through May. If there are pockets of drier conditions in the U.S. Midwest this spring, we could see the corn market rally $50-$70/tonne quite easily.

We’re bullish on the corn and barley markets for the next six months. The feed grains complex will trend higher until the 2025 crops are more certain. Early in the fall of 2024, we advised feedlots using barley or corn to have coverage until July 2025. Strength in the feed grains will limit the upside potential in the feeder market in late spring and summer.