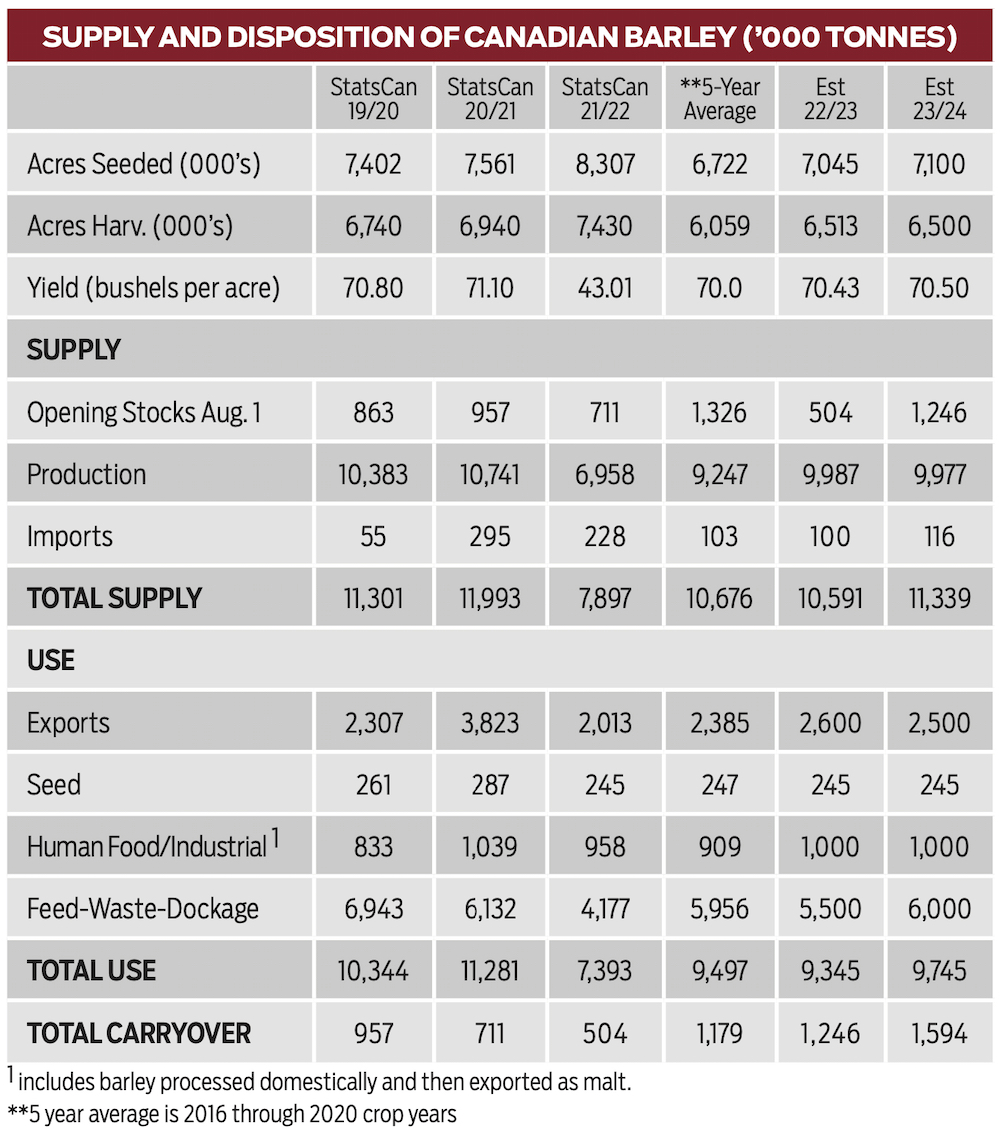

Cow-calf producers are wondering how changes in the feed grain complex will influence the feeder market. At the same time, feedlot operators are wondering if they should take coverage in the deferred positions. I thought this would be a good time to provide an overview of the barley market.

Canadian barley fundamentals are snug and the barley market needs to encourage acreage for 2023. Prices may incorporate a risk premium during April and May due to production uncertainty. Geo-political events will also influence the world market and Canadian export projections for the 2023-24 crop year. Last year, China stepped forward for new crop barley in February and March. Traders are watching Chinese buying patterns as this will again influence new crop price structure. Second, the Black Sea Grain Initiative is set to expire in March. We could see a significant rally on the world market if exports cease out of the Black Sea region. There are considerable risks.

[RELATED] Feed weekly outlook: Grain stocks set tone for barley, wheat

Read Also

Cattle Market Summary

Break-evens, cow and calf prices, plus market summaries courtesy of Canfax and Beef Farmers of Ontario. Cost of Production September…

During the first half of January, Lethbridge area feedlots were buying feed barley in the range of $440-$450/tonne delivered while central Alberta operations were showing bids in the range of $410-$430/tonne. The feed barley market has been relatively flat throughout the winter, which is not abnormal. Barley market upside has been limited due to competition from alternate feed grains. At the time of writing this article, U.S. corn was trading in the range of $440-$450/tonne delivered in the Lethbridge area. U.S. corn imports were increasing because prices were competitive with domestic barley values. Wheat for feed usage was trading from $430-$440/tonne in central and southern Alberta. The average elevator bid for No.1 and No. 2 CWRS in Alberta was $440/tonne. Farmers are selling milling wheat into domestic feed channels in the short term. For new-crop, feed barley has traded in the range of $390-$400/tonne delivered in southern Alberta for September through December positions.

As I write this, Statistics Canada will release their Stocks of Principal Field Crops as of December 31, 2022, on February 7. These reports confirm the 2022 production estimate and estimate feed usage during the first five months of the crop year. I am forecasting farm stocks as of December 31 to come in at 5.3 million tonnes. This is up from the last year’s on-farm stocks of 2.8 million tonnes and marginally higher than the December 31, 2020 supplies of 5.1 million tonnes. This is somewhat bullish for the spring given feed usage in the latter half of the crop year. The Lethbridge feed market is discounted to imported U.S. corn values. The barley market needs to ration demand. It’s more likely that barley prices will trade above imported U.S. corn prices from March through July.

Given the tighter fundamentals for the 2022-23 crop year, the barley market must encourage acreage this spring. At this stage, Canadian barley acres are projected to come in at 7.10 million, up marginally from the 2022 seeded area of 7.04 million acres. The market cannot afford a crop problem. If average yields don’t materialize this summer, we could see another major barley market rally.

Two main factors will influence Canadian barley exports for the 2023-24 crop year. First, the World Trade Organization is expected to resolve the Chinese tariffs on Australian barley in the first few months of 2023 although there is no word at the time of writing. However, if China lifts tariffs on Australian barley, Canadian exports will be down sharply. Second, the UN negotiated an extension to the previously mentioned Black Sea Grain Initiative in late November. If this agreement is not extended, we could see a major rally in all coarse grains similar to the spring of 2022.

I expect the barley market to rally in April and May. Once the crop is more certain, prices could soften. Price lows will likely occur during August. Feedlot operators should cover the bulk of their feed grain requirements through July. This could temper yearling market upside in the spring but it won’t affect calves much. If yields come in below the five-year average, fundamentals become historically tight, similar to the 2020 and 2021 crop years. No one can forecast how geo-political events will play out. These factors tend to support the barley market until events are confirmed.