I’ve received many inquiries from cattle producers about the feed grain outlook for the 2025-26 crop year. Cow-calf producers have sold a record number of calves and yearlings for fall delivery. Feedlot operators are factoring in a fairly aggressive cost per pound gain in anticipation of larger feed grain supplies this fall. Following is a market overview and fundamental outlook for Canadian barley.

In late June, Lethbridge-area feedlots were buying feed barley in the range of $315-$320/tonne delivered while cattle operations in the Red Deer region were showing bids from $290-$310/tonne delivered. The barley market has remained firm late in the crop year due to historically low ending stocks for the 2024-25 crop year. For September and October, the southern Alberta barley market is quoted at $275-$290/tonne delivered. Western Canada’s malt barley market has been rather quiet throughout the spring and summer. Malting companies will likely be more aggressive with purchases at harvest.

In late June, imported U.S. corn was trading in the range of $305-$310/tonne in southern Alberta. U.S. corn imports into Western Canada have been lower than anticipated in the 2024-25 crop year. Corn was trading at a sharp discount to barley for July and August. Feed wheat was trading in the range of $315-$330/tonne delivered in central and southern Alberta. The average elevator bid in Alberta for No.1 and No.2 CWRS 13 per cent protein was $315/tonne. Farmers have been encouraged to sell milling wheat into domestic feed channels in the latter half of the 2024-25 crop year, limiting upside in feed barley prices.

The 2024-25 barley carryout is projected to drop to 500,000 tonnes. This is down from 2023-24 ending stocks of 1.2 million tonnes and down from the 10-year average of 1.1 million tonnes. This is the main factor for price strength in July and August. On-farm stocks as of July 31 are expected to be at bin-bottom levels.

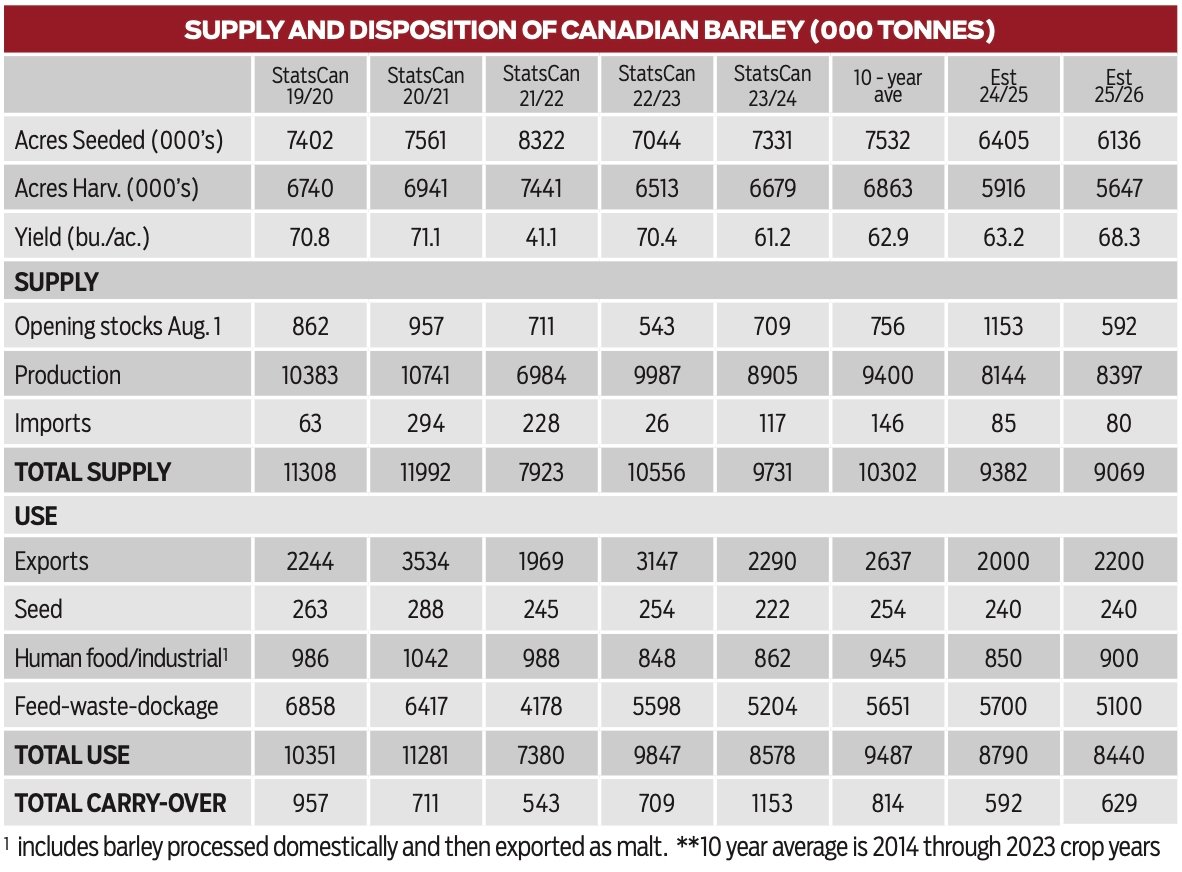

Canadian farmers seeded 6.135 million acres of barley this spring, according to Statistics Canada. This compares to the 2024 planted area of 6.405 million acres and the 10-year average of 6.9 million acres. Using a traditional abandonment rate and a 10-year trend yield of 68.3 bu./ac., production has potential to finish near 8.4 million tonnes, up from the 2024 crop of 8.144 million tonnes but below the 10-year average of 8.745 million tonnes.

Read Also

Cattle Market Summary

Break-evens, cow and calf prices, plus market summaries courtesy of Canfax and Beef Farmers of Ontario. Cost of Production August…

We’re expecting barley exports for the 2025-26 crop year to reach 2.2 million tonnes, similar to the 10-year average. China is the largest buyer of Canadian barley. Canadian barley exports to China largely depend on Australia’s barley crop. At this stage, the Australian barley crop for 2025-26 is projected to finish around 12-12.5 million tonnes, down from the 2024-25 output of 13.3 million tonnes. Chinese buyers usually purchase much of their Canadian barley in late July or August.

Given export projection, domestic feed usage will be around 5.1 million tonnes, allowing for a 2025-26 carryout of 629,000 tonnes.

Canadian farmers will sell 1.0-1.1 million tonnes of barley during October and November. It’s important to know that cattle-on-feed inventories in Western Canada are at seasonal lows during September and October. Domestic feed demand during these two months is only about 350,000 tonnes. When supplies exceed demand, prices are lower. Therefore, feedlot operators need to buy as much barley as possible in the fall. Lower barley prices will support the feeder market during the fall and allow feedlots to lock in a competitive cost-per-pound gain.

U.S. farmers planted 83.5 million acres of corn this past spring. Using a traditional abandonment rate and a trend yield of 181 bu./ac., production has the potential to reach 399 million tonnes, up from the 2024 output of 378 million tonnes and up from the five-year average of 365 million tonnes. The U.S. farmer sells over half of the crop in the first three months of the crop year. This comes on the heels of a Brazilian harvest of 150 million tonnes, up from last year’s crop of 119 million tonnes.

We expect Western Canadian corn imports to reach 2.0-2.5 million tonnes in the 2025-26 crop year. Alberta barley prices in southern Alberta will likely be discounted to the value of imported U.S. corn during September and October. This winter and in the spring of 2026, Lethbridge barley prices will likely be premium to imported corn. The main takeaway from the acreage reports is that feed grain supplies will be plentiful in the 2025-26 crop year, supporting feeder cattle prices.