Feeder cattle markets in Western Canada have been trading near seven-year highs throughout the fall. Feeder cattle supplies are sharply below year-ago levels on both sides of the border. While supplies are tighter, demand from feedlots for replacement cattle has been significantly greater than last year. Finishing operators in Western Canada have been able to lock in fed cattle prices for the spring of 2023 at a live price range of $210-$215. The previous record high was around $205 in the spring of 2015 and 2017. Barley prices have also been strengthening but feeding margins look favourable for February through June time frame of 2023. I received many inquiries over the past month regarding the price outlook for feeder cattle. Many producers are wondering if they should hold back on heifers or expand their herd by purchasing cow-calf pairs. In this article, I’ll discuss a few factors that will influence the feeder market over the next six to eight months.

Feeder cattle prices in Western Canada are near historical highs but this is not the case in the U.S. The drought in the Southern Plains has caused cattle producers to continue contracting the herd for one more year. Consider the following statistics. U.S. heifers entering the cow herd on July 1, 2023, were 7.9 million head, down from 8.1 million head 12 months earlier. Second, the U.S. cow slaughter continues to exceed expectations. The U.S. beef cow slaughter for 2022 is on track to reach 3.9 million head, up from the 2022 number of 3.63 million. This surpasses the previous high of 3.86 million during 2011.

Cattle grazing on small grain pastures over the winter in Oklahoma, Texas and Kansas will be down from year-ago levels. U.S. pasture conditions in late September were only 26 per cent good-to-excellent. Only nine per cent of the U.S. winter wheat emerged during the last week of September. I’m projecting the USDA to report cattle grazing on small grain pasture on January 1, 2023, to come in at 1.3 million head, down from the January 1, 2022 number of 1.7 million head. These cattle typically move into feedlots in March when the winter wheat comes out of dormancy. Ironically, pasture and winter wheat conditions during September 2022 are very similar to conditions of 2012. On January 1, 2013, the number of cattle on small grain pasture was also 1.3 million head.

The feeder cattle market in the U.S. is not encouraging expansion. During September 2022, steers in Oklahoma City weighing between 500-550 pounds averaged US$197/cwt. This compares to the average price of US$270 during September 2014 when U.S. feeder cattle prices were at historical highs.

Read Also

Cattle Market Summary

Break-evens, cow and calf prices, plus market summaries courtesy of Canfax and Beef Farmers of Ontario. Cost of Production September…

Feeder cattle placements have been larger than anticipated during the summer and early fall periods due to lower heifer retention and drought in the U.S. Southern Plains.

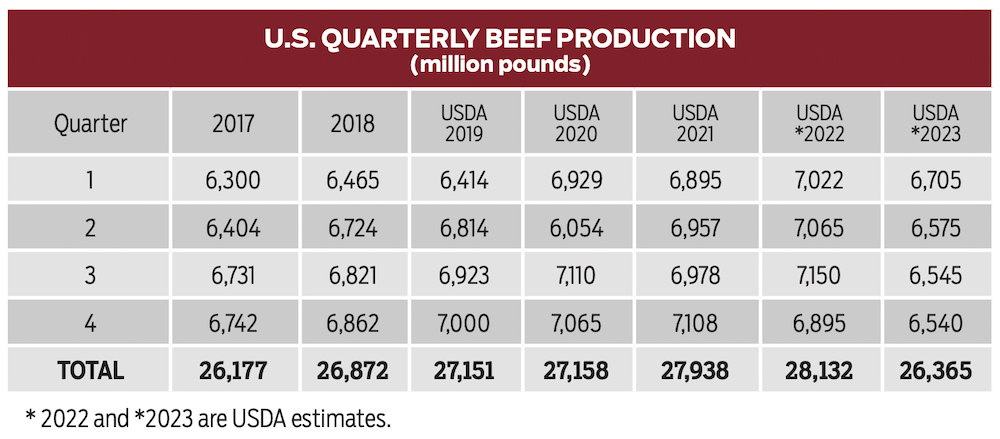

U.S. feedlot placements will decline in upcoming months due to the year-over-year decrease in the calf crop. Lower feedlot placements will result in lower fed cattle supplies and a sharp year-over-year decrease in U.S. beef production. Notice that U.S. beef production during the fourth quarter of 2023 is forecasted to drop to 6.5 billion pounds, down nearly 450 million pounds from the fourth quarter of 2022 and down almost 600 million pounds from the same time frame of 2021. This will result in very strong feeder cattle prices during the summer of 2023.

During September and October of 2014, Alberta prices for steers weighing 500-600 pounds were averaging C$300-$320/cwt. Prices in September and October 2022 were in the range of C$270-$290/cwt for these same weight feeders. The market is high enough to encourage expansion. I’m expecting about 70,000 heifers to be held back for herd expansion in Western Canada. In most regions, forage conditions are favourable. Keep in mind that feeder cattle outside feedlots in Western Canada as of July 1, 2022, were down about 274,000 head from July 1, 2021. Heifer retention will further tighten the supply situation in Western Canada. Feeder cattle supplies outside finishing feedlots on January 1, 2023, in Western Canada could be down as much as 400,000 head from January 1, 2022.

At the time of writing this article, the November feeder cattle futures were trading at $179. The March feeder cattle contract was hovering at $182. However, the August 2023 contract was over $201. The feeder cattle market will remain relatively flat over the winter but then trend higher from April through August of 2023. Grass cattle next spring will likely trade near historical highs and we’ll likely see fresh historical highs for the yearling in August of 2023. Canadian cow-calf producers planning to expand the herd this winter probably have a one-year jump-start on their U.S. counterparts. Producers will be in good financial shape over the next two years.