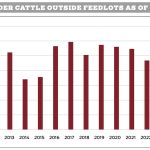

The December live cattle futures made a low of $173.50 on September 9. At the time of writing this article, the December contract was $189. During September and October, the live cattle futures rallied about $16. In the U.S., the four largest packing firms handle 85 per cent of all steer and heifer purchases. Apparently, […] Read more