Interest rates in Canada and the U.S. have been increasing over the past year as central banks work to bring down inflation. The Bank of Canada and the U.S. Federal Reserve started their policy of monetary tightening in March 2022. One year later, the U.S. Federal Reserve’s benchmark rate was at 5.0 per cent while the Bank of Canada’s key lending rate was at 4.5 per cent. I’ve received many calls over the past few months regarding the outlook for interest rates.

During the COVID years, interest wasn’t a significant factor in feedlot operating costs. Since late fall, feedlot operators have been factoring in another $60-$70 per head in interest costs. More importantly, cattle producers are concerned about the economy in general. How will higher interest rates influence consumer spending longer-term? Will there be a significant rise in unemployment? How long will this cycle of monetary tightening last? In this article, I’ll take a closer look at the past to indicate future economic projections on interest rates, inflation and unemployment.

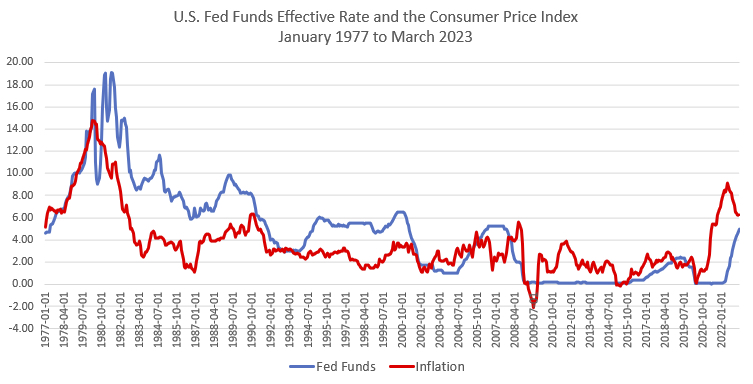

Many subscribers to Canadian Cattlemen remember the early 1980s when inflation and interest rates were at historical highs. U.S. inflation topped out in March 1980 at 14.8 per cent. The U.S. Federal Reserve’s fed funds rate peaked in June 1981 at 19.1 per cent. The economy basically came to a standstill until inflation started to abate. Consumers reined in their travel and eating out. Disposable income decreased for the average individual. The U.S. unemployment rate was at 6.4 per cent in 1977 and reached 11 per cent in 1982. Accounting for inflation, real hourly wages decreased from 1977 to 1983. The standard of living deteriorated for most households and individuals.

Read Also

Building demand together: The impact of Canada’s beef import levy

The beef import levy has become a central tool for ensuring balance in Canada’s beef industry

I’ve attached a chart showing the U.S. federal funds rate and the U.S. consumer price index (see at top). The federal funds rate is the target interest rate set by the Federal Reserve at which commercial banks borrow and lend their extra reserves to one another overnight. This rate setting by the Federal Reserve either tightens or loosens the money supply.

When there is excess demand in the economy, the fed funds rate needs to exceed inflation to lower consumer demand. On the attached chart, the fed funds rate was above inflation until the early 2000s. At that time, the economy transitioned from excess demand to limited demand. The central banks in Canada and the U.S. needed to stimulate spending and borrowing through lower interest rates.

After COVID, central bankers believed that inflation was transitory. Many analysts believed inflation would be short-lived. However, time told a different story. The government stimulus cheques were more powerful for the economy than supply chain delays and the Russian invasion of Ukraine. U.S. and Canadian inflation peaked in June 2022 at 9.1 per cent. Since then, inflation has slowly decreased largely due to lower energy prices. Natural gas futures are now below pre-COVID levels and gas prices are down 30 per cent from the June 2022 peak. However, the core inflation level, which excludes food and energy, remains elevated near five per cent. High energy prices are considered an extra tax on the medium and lower income brackets. Lower energy prices are like a tax decrease. There has been a temporary increase in disposable income this past winter.

It takes 12 to 16 months for interest rate hikes to work through the economy. The aggressive monetary tightening that occurred during the summer and fall of 2022 will only be felt in the latter half of 2023. U.S. and Canadian economies will experience positive GDP during the first half of 2023. Consumer spending will start to decline in summer. The unemployment rate will start to increase in the fall. Ideas are that U.S. employers could shed 500,000 to one million jobs between September and December. Canadian full-time positions have the potential to drop by 200,000. The loosening of the labour market will be key to bringing down the core inflation level.

Consumer spending comprises about 70 per cent of U.S. GDP. A one per cent decrease in consumer spending equates to a one per cent decrease in beef demand. Restaurant and grocery store spending will trend lower in the latter half of 2023. This lower demand comes at a time when cattle prices are at historical highs. The market will be rationing demand when overall total demand is declining. This makes for an extremely volatile market and enhances the need for prudent risk management. As a rule of thumb, the cattle market lags the economy by about four months. People change their behaviour over time. For example, it takes about four months for an individual to rack up their credit card.