U.S. and western Canadian feeder cattle prices have been consolidating over the past month. Higher-quality medium-flesh steers averaging 850 pounds have been trading in the range of $180-$185 while 600-pound steers have been trading in the range of $220-$230. Earlier in winter, I and many other analysts were expecting placements into U.S. and Canadian feedlots to decline in March and April due to the year-over-year decline in the U.S. calf crop. Lower available supplies would result in higher prices; however, it now looks like the expected rally in the feeder cattle prices may be delayed. U.S. feedlot placements in the first three months of 2022 were 5.68 million head, down only 28,000 head from the first three months of 2021; western Canadian feeder cattle placements were 459,300, up about 7,000 head from first quarter of 2021. I’ve received many calls regarding the outlook for feeder cattle supplies for the remainder of 2022, therefore, I thought this would be an opportune time to update key data.

The USDA increased the 2020 calf crop by 359,000 head on the January 1, 2022 cattle inventory data. Read this next part carefully to fully understand. On the January 1, 2021 cattle inventory data, the 2020 calf crop was 35.136 million head. On the January 1, 2022 data, the 2020 calf crop was revised upward to 35.495 million head. Some of these calves were born in the latter half of 2020, resulting in a larger fed cattle supply in the first half of 2022.

The 2021 calf crop was estimated at 35.085 million head on the recent January 1, 2022 U.S. inventory report. Essentially, we have nearly the same number of calves as we thought last year at this time. There is only a difference of 51,000 head, which is not sufficient to influence the market. (35.136 million head minus 35.085 head which equals 51,000 head).

Second, the U.S. Southern Plains is experiencing a major drought. As of May 8, only 18 per cent of U.S. pasture was rated good to excellent. In addition to the drier conditions, hard red winter wheat and winter rye prices are sharply higher than last year. Farmers are not grazing out small grain pastures but rather moving cattle off winter grains sooner than normal.

Read Also

Are you a competitive supplier of weaned beef calves?

Beef farmers and ranchers need to strategically manage costs to achieve and maintain profitability.

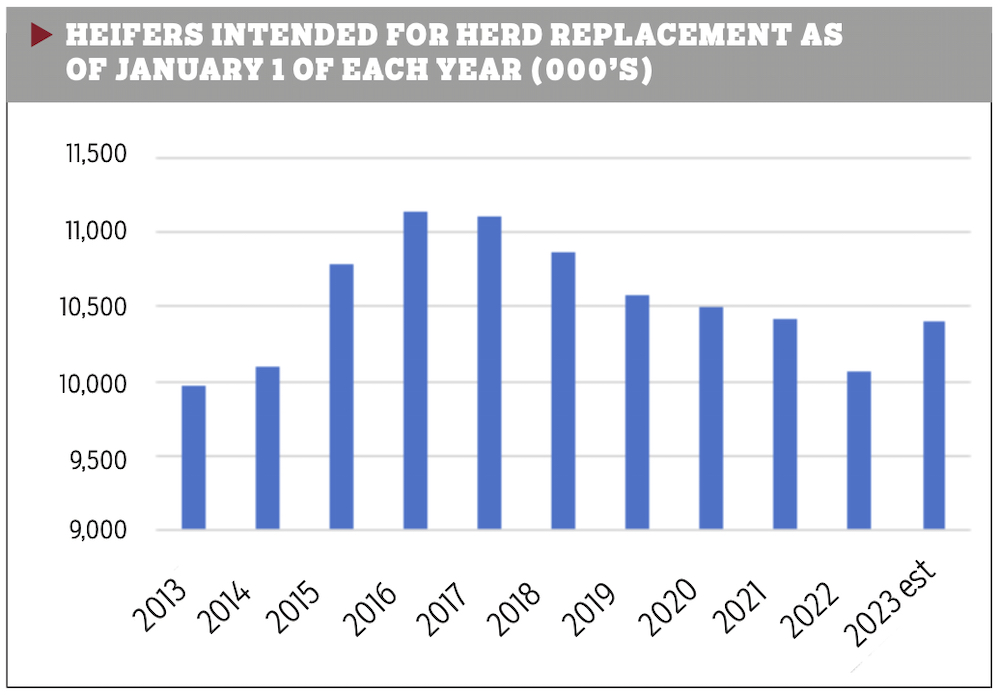

Third, we’re seeing a drop in heifers intended for herd replacement. Heifers for herd replacement on January 1, 2022 were 10.062 million head, down 349,000 head from January 1, 2020. There are an additional 349,000 head of heifers moving into the feeder cattle supply compared to last year. On a side note, the U.S. beef cow slaughter for the first quarter of 2022 was 978,700 head, up 143,700 head from the same timeframe of 2021. The U.S. cattle herd continues to contract.

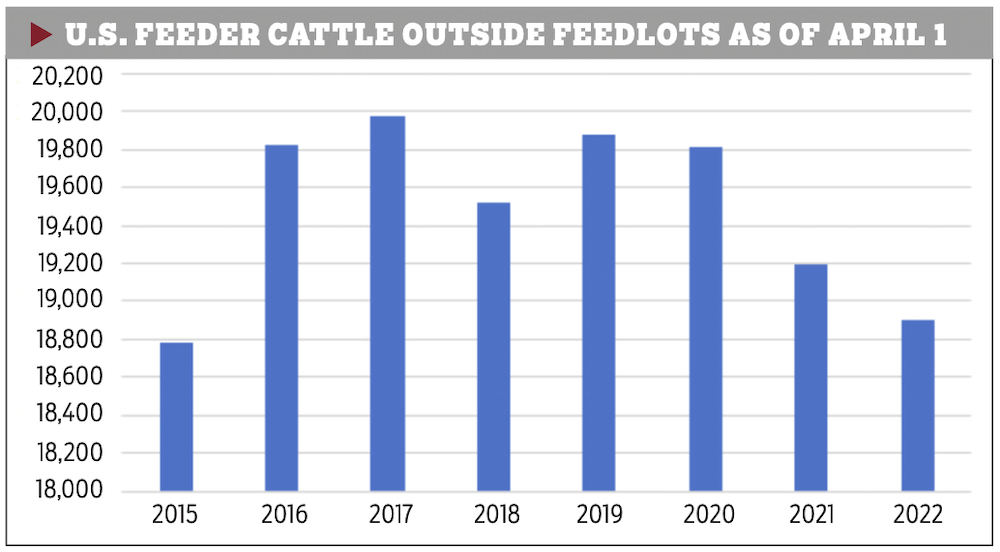

How does the supply change in the latter half of 2022? There is good news. Available feeder cattle supplies will shrink. As of April 1, 2022, U.S. feeder cattle supplies outside feedlots were 18.903 million head, down 287,000 head from last year. It looks like the market is over the “hump of supplies” and will now be downhill.

Given the year-to-date beef cow slaughter and number of cows available to calve, the U.S. 2022 calf crop is expected to drop to 34.4 million head, down 685,000 head from the 2021 calf crop of 35.085 million head. In addition to the lower calf crop, I’m expecting the numbers of heifers for herd replacement to increase in the fall period. I’m expecting U.S. cow-calf producers to hold back about 350,000 head of heifers for herd replacement. Feeder cattle supplies during the upcoming fall and winter have potential to be down over one million head from last year. Lower supplies will result in higher prices.

Lower feeder cattle outside feedlots on April 1 will result in lower feedlot placements over the next three to four months. U.S. beef production will experience a sharp year-over-year decline in the final quarter of 2022 and first quarter of 2023. This will be positive for fed cattle prices. The market outlook for fed cattle and feeder cattle is favourable for the October 2022 through March 2023 time frame.