I’ve received many calls from cow-calf producers inquiring about the U.S. and cattle cycle. The recent droughts in the U.S. and Western Canada have resulted in a year-over-year increase in the cow slaughter. Many producers in Canada and the U.S. have liquidated a portion of their herds due to limited feed supply. At the same time, barley prices continue to hover near historical highs. At the time of writing this article in mid-September, western Canadian yearling prices were making fresh 52-week highs. It appears that calf prices are struggling to move higher despite the year-over-year decline in the U.S. calf crop. The market environment is in a very precarious situation. In this issue, I will provide a forecast for the 2021 and 2022 calf crops. I’ll also review factors that will influence the feeder cattle market for the next 12-month period.

Read Also

The Canadian Cattle Association’s international advocacy efforts

Global ag policies affect Canadian food policy, so the Canadian Cattle Association participates in international and domestic forums

The USDA and Statistics Canada released their July 1 semi-annual cattle inventory reports earlier in summer. It’s important to note that the USDA calf crop estimate in July has a large margin of error. In past years, we’ve seen significant revisions between the July estimate and the official number that comes out in January. The USDA estimated the 2021 calf crop at 35.1 million head, down only 35,500 head from the 2020 calf output of 35.13 million head. I believe there will be a sharper year-over-year decline in the calf crop for two main reasons.

First, the USDA estimated the number of beef cows that had calved as of July 1 at 31.4 million head, down 650,000 head from July 1, 2020. Second, the U.S. cow slaughter from January 1 through July 31 was 2.05 million head, up 129,000 head from last year. Therefore, I’m estimating the 2021 U.S. calf crop at 34.7 million head, down 435,000 head from the 2020 calf crop of 35.13 million head. This comes on the heels of a year-over-year decline of 455,000 head from 2019 and 2020. If my estimate for 2021 is correct, the U.S. will have contracted the calf crop by approximately 900,000 head over the past two years. Early forecasts for 2022 have the U.S. calf crop dropping another 400,000-500,000 head.

Statistics Canada estimated the 2020 calf crop at 4.34 million head, up 9,000 head from 2019. The Canadian calf crop has been relatively flat over the past three years and we’re not likely going to see much of a change for 2021. The 2021 drought will result in a major year-over-year change in 2022. I’m expecting the Canadian calf crop for 2021 to come in at 4.33 million head and early forecasts have the 2022 calf output at 4.23 million head. It will only be down about 100,000 head and this is not significant enough to change the market structure.

In Western Canada, feedlot placements in Alberta and Saskatchewan from May through July were 359,300 head, up nearly 115,000 head from the same time frame last year. This will result in a tighter feeder cattle supply situation later in Western Canada during the fall period. This should result in higher prices for calves in November and December.

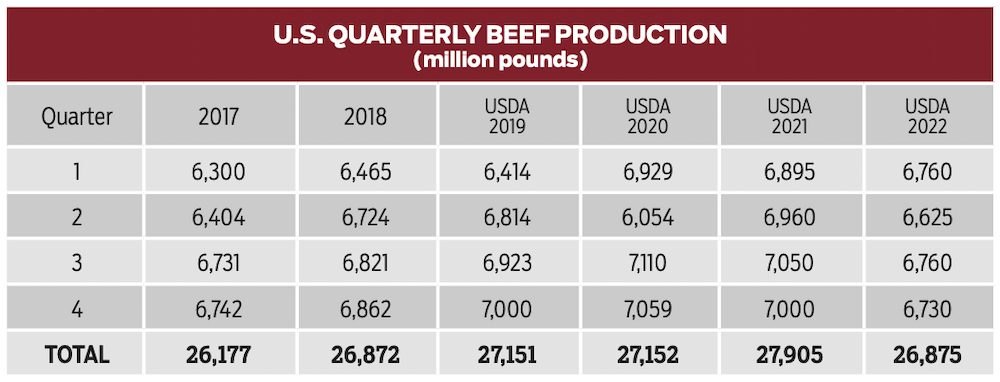

The lower calf crops in 2020 and 2021 will result in a sharp year-over-year decline in beef production for 2022. Annual U.S. beef production is forecasted to decline by nearly one billion pounds, which is a significant year-over-year decrease coming in the second and third quarters. This will also keep the feeder cattle well-supported in Western Canada. We may see the live cattle futures incorporate a risk premium due to the uncertainty in production.

Finally, western Canadian weather patterns occur in 18-year cycles. We all remember 2003 was extremely dry as was 2021; the summer of 2004 had above-normal precipitation and below normal temperatures. It was wet and cold; some may remember we had a frost on August 19, 2004. That brought excellent yields and a fair amount of feed wheat. This bodes well for feeder cattle prices during the fall of 2022.

In conclusion, the contracting U.S. calf crop will result in greater demand from south of the border for Canadian feeder cattle prices. Cow-calf producers sold more feeder cattle in the summer, resulting in lower available supplies for the fall. Next spring, the market will be contending with a year-over-year decline in beef production. In the fall of 2022, feed grains will be burdensome. The U.S. and Canada will be contending with another year-over-year decline in the calf crop. The most profitable years for the cow-calf producer will be 2022 through 2025, exactly 10 years after the previous rally to historical highs.