U.S. herd expansion in 2015 means more calves are available south of the border this fall. In contrast the Canadian herd continued to contract. As U.S. beef production rebounds in 2016, there is potential for beef and cattle prices to decline. Current prices are being supported by a lower exchange rate. Has Canada missed out on the largest expansion opportunity this generation may ever see?

Canadian herd shows no growth

Statistics Canada reported total cattle inventories on July 1, 2015 were down 2.1 per cent at 13 million head. Beef cow inventories were down 3.4 per cent or 134,400 head to 3.79 million head. Regionally, Alberta with the largest beef cow herd at 1.5 million head was down 4.4 per cent from last year. Followed by Saskatchewan with 1.15 million head down 2.8 per cent; Manitoba with 448,300 head down 2.2 per cent; Ontario with 276,300 head down 4.5 per cent; and British Columbia with 190,500 head down 1.9 per cent, Quebec with 177,800 head down 2.1 per cent, and Atlantic Canada with 43,200 head down 2.5 per cent.

Read Also

Body condition, nutrition and vaccination for brood cows

One of the remarkable events of the past century related to ranching has been the genetic evolution of brood cows….

The answer to the question, were producers retaining breeding heifers this summer was a disappointing no. Beef breeding heifers were down 0.6 per cent or 3,600 head to 612,600 head. While heifer placements into feedlots were down in the first quarter they quickly jumped back up to historic levels as dry conditions became apparent in parts of the western provinces. Despite improved weather conditions in late July and August, it was too late to reverse those decisions and another year has been lost.

The 2015 calf crop was down 3.7 per cent and feeder exports in the first half of 2015 were strong. This will limit beef production in 2016. Canadian feeder and calf supply outside of feedlots were down 1.5 per cent or 86,240 head. Overall, this implies around a 3.0 per cent reduction in fed marketings in 2016 assuming feeder exports in the fourth quarter are steady to lower than last year.

U.S. growth

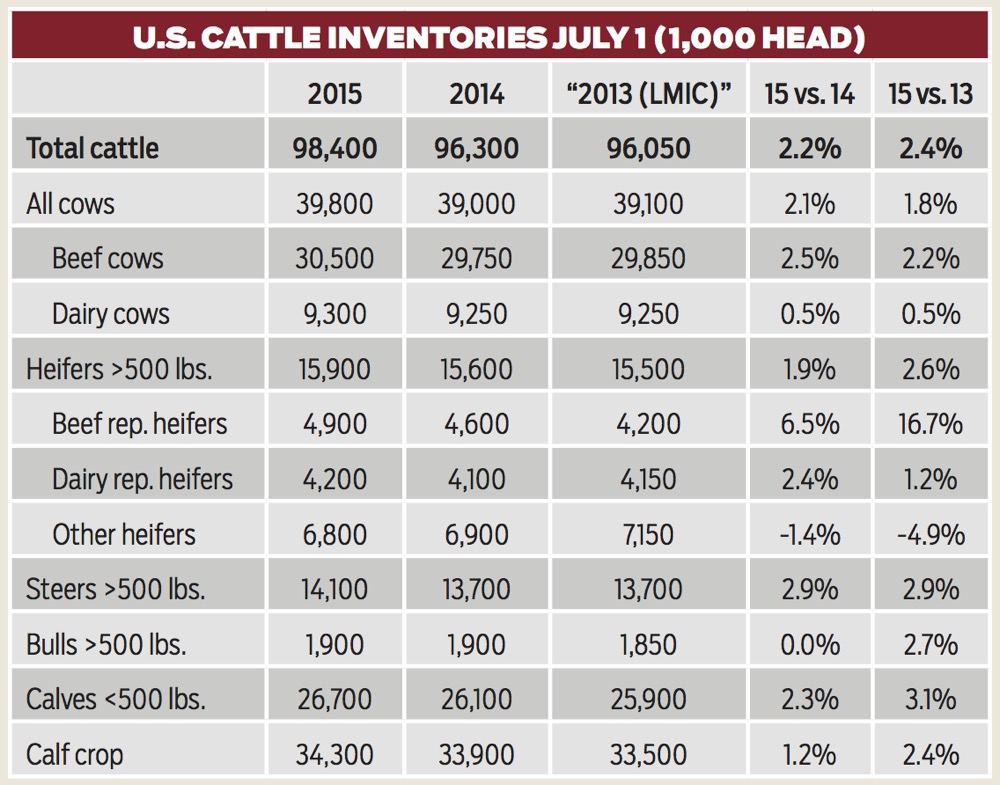

In contrast, the U.S. is in full expansion mode with July 1 total cattle inventories up 2.2 per cent at 98.4 million head. Beef cows were up 2.5 per cent at 30.5 million head and beef replacement heifers were up a sharp 6.5 per cent at 4.9 million head as the industry responds to some of the strongest expansion signals since the mid-1990s. This was the first time July 1 cattle inventories increased since 2006. Very strong cattle prices and profitability combined with improved grazing and pasture conditions is finally allowing the U.S. herd to grow. This follows annual declines in cow numbers in 17 of the last 19 years. As cattle prices have come down this fall, expansion efforts will slow.

A larger 2015 calf crop (+1.2 per cent or 400,000 head) and a larger number of non-replacement cattle outside feedlots (+2.0 per cent) will support beef production in 2016. USDA is projecting beef production to be up 6.0 per cent in 2016 which will potentially pressure beef prices in North America down.

Prices and profitability

The U.S. cattle market has removed all the gains seen over the last couple of years. At the end of September U.S. fed cattle prices were the lowest since the summer lows in August 2013. While the lower Canadian dollar supported the domestic market throughout the first half of the year, Alberta fed cattle prices have dropped 21 per cent from the spring high. At $160/cwt the end of September they were steady with last year. The 10-year (05-14) average would suggest September should be an annual low with prices strengthening five to six per cent in the fourth quarter. However, September 1 cattle on feed were up 3.0 per cent from last year and fed cattle markets are expected to be steady with last year in the fourth quarter after being 7.0 per cent lower from January through September. In addition, larger carcass weights have meant fed beef production year to date is down only 3.4 per cent. If slaughter numbers match 2014 larger carcass weights will mean more high-quality beef will be available potentially removing some or all of the seasonal price rally.

Producers have the greatest capacity in history to respond to price signals for more production. Increased production does not only come from more cows in the herd; but through management and technology more pounds of beef can occur in a matter of months whereas previously it took years. Longer days on feed and heavier carcasses equal more pounds without herd expansion. This has implications for the cattle cycle which ultimately responds to the supply of beef.

Feed grains

Lethbridge barley averaged $219/tonne in September up 23 per cent from last year. Canadian barley production is projected to be up 7.0 per cent this fall to 7.6 million tonnes. even if yields end up being better than forecast, production is still at historic low levels. The ending stocks-to-use ratio for the 2015-16 crop year is projected to be steady at 22 per cent.

Ontario corn averaged $193/tonne in September, up 6.0 per cent. Canadian corn production is projected to be up 7.0 per cent at 12.3 million tonnes. U.S. corn production is forecast to be down 5.0 per cent at 13.6 billion bushels but the stocks-to-use ratio will drop to 13 per cent from 15 per cent in 2014-15. Omaha corn prices averaged C$197.50/tonne in September up 31 per cent from last year. This has narrowed the feeding disadvantage in Western Canada and is discouraging further feeder cattle exports from going south.

Feedlot margins squeezed

Feedlot break-evens continue to increase with both feeder cattle and feed prices up from last year. The Canfax TreNDS report shows projected feedlot margins, based on the live cattle futures, have been close to break-even in the first part of 2015 but will be negative in the fourth quarter. meanwhile, the cash market has provided a significant profit. This is about to change as break-evens continue to climb while cash prices have seasonally dropped. Feedlot margins are expected to be less favourable in 2016, particularly if the U.S. market remains under pressure.

Replacement ratios

The lower the replacement ratio the fewer dollars the feedlot must pay to replace a fed animal with a feeder; conversely a higher ratio means the feedlot must pay more per pound to replace those animals. Replacement ratios have been increasing throughout 2015. In the third quarter, all ratios in the west were eight to 11 per cent higher than last year and in the east they were two to six per cent higher. Higher replacement ratios have encouraged feedlots both north and south of the border to feed cattle to record-large carcass weights. Steer carcass weights reached 921 lbs. in September, surpassing the previous high of 917 lbs. in 2014.

Feeder prices

Alberta 500- to 600-lb. steer calves averaged $309/cwt in September up 15.6 per cent from last year. Historically calf prices have been steady to stronger in the fourth quarter increasing as much as one to two per cent from September to December. over the last five years this rally has been even larger around five to six per cent. but prices are expected to be pressured lower throughout the fourth quarter this year, with lower fed cattle prices and higher feed costs. Prices have already dropped 12 per cent and the decline could be as large as 21-32 per cent, putting calf prices potentially as low as $230-$262/cwt. While this would be down from last year’s $288/cwt in the fourth quarter it would be still be well above 2013’s $165/cwt.

Cow-calf profitability will remain positive and strong in 2015. With several profitable years since 2011 cow-calf producers have rebuilt equity lost and are able to make infrastructure investments. All of the market signals are there to expand, weather permitting, but producers remain cautious.

Consumer demand strongest since 1989

Retail beef prices peaked in July 2015 at $20.27/kg before stabilizing at $20.12/kg in August. This is still 15 per cent higher than last year. In contrast, pork is only up 7.0 per cent from last year and poultry is up 5.5 per cent. The beef/pork price ratio has largely adjusted in 2015 and is almost back at the long-term average. In contrast, beef remains historically high compared to poultry at the meat counter. Canadian pork production, up 2.0 per cent year to date, has provided only minor pressure on the beef complex. But U.S. pork production is projected to be up 7.4 per cent in 2015. This has created significant pressure south of the border and has indirectly impacted the beef market here. In 2016, U.S. pork production is expected to be steady as beef production grows. This is anticipated to bring the price relationship back in line with historical averages. U.S. poultry production is projected to be up 3.8 per cent in 2015 and up another 2.7 per cent in 2016. Broiler production was largely unaffected by HPAI. Larger production will keep poultry prices low in comparison to beef.

Have consumers hit the end of their rope? Not yet, retail beef demand is forecast to have held up in 2015 and be the strongest since 1989. The good news is it appears wholesale prices have finally been fully priced into retail prices. Retail beef prices were down modestly in August and should stabilize throughout the fourth quarter. After a 16 per cent increase in 2014 and 14 per cent increase year to date in 2015, stable retail prices will give consumers a chance to adjust to a new price reality.

International demand has been a bumpy ride in 2015, but remains strong. From January through August 2015, Canadian beef exports were steady in volume but up 20 per cent in value. Reduced Canadian beef production, record-high beef prices, and the temporary trade restrictions following the February 2015 BSE case all contributed to hold down volumes. Exports have been supported by a lower Canadian dollar; but a major question is, can Asian demand be sustained particularly with slower economic performance? Growth in Asian imports is driven by higher incomes, so any uncertainty in economic performance translates into volatility in global beef markets. The announcement of the Trans-Pacific Partnership on October 5, 2015 has added optimism; but it will take time before it is ratified by all the countries involved and start impacting markets. Despite all of the uncertainty in global markets, international demand for Canadian beef in 2015 is projected to be the strongest in history.

Culling rates down, but not enough

The beef cow-culling rate is projected to drop from 13.8 per cent in 2014 to 12.4 per cent in 2015. While still above the long-term average of 11 per cent for a stable herd it is getting closer. Domestic cow slaughter was down 13 per cent from January to September; while live exports were down 20 per cent. Regionally cow slaughter is down 10 per cent in the west and 24 per cent in the east; while exports are down 40 per cent in the west and steady in the east. After being down significantly in the first half of the year, cow marketings have run closer to year-ago levels in the third quarter with concerns over dry pasture conditions and higher winter feed prices. Overall, cow marketings (domestic slaughter + exports) are projected to be down 10 per cent in 2015.

Alberta D1,2 cow prices peaked in April at $148/cwt, up 41 per cent from 2014. Prices dropped 9.5 per cent to $134/cwt in September, then plummeted to $120/cwt the beginning of October. Another 5.3 per cent decline is typically seen from October to November — this would put the annual low around $111-$114/cwt. Trim prices have recently fallen below year-ago levels with larger non- NAFTA imports (+26 per cent) and end cuts from fed cattle being ground into hamburger to increase supplies.

Alberta cows have traded at a premium to the U.S. market for much of 2015. The exception being July when drought-induced selling pushed prices down. As the feed situation has become clearer and U.S. prices have dropped with larger grinding supplies the premium returned in September ($7.40/cwt). This is expected to keep cows in Canada in the fourth quarter.

Heifer slaughter down

Heifer marketings in 2015 are anticipated to be down 18 per cent compared to steer marketings which are projected to be down 8.0 per cent. The heifer slaughter ratio, the number of heifers marketed for every 100 steers, is projected to drop to 63, down from 74 in 2014 and below the 20-year average of 69. This would be the lowest heifer slaughter ratio since 2003 and would support breeding numbers in 2016.

The Alberta 550-lb. steer-heifer price spread has dropped from a high of $30/cwt in May to $23/cwt in September, similar to last fall. While part of the wider spread back in May was due to differences in performance at a higher price level, the decline also indicates less interest in retaining heifers compared to this spring.

This may rebound as the fall run gets underway. But given lower fed cattle prices this may not occur.

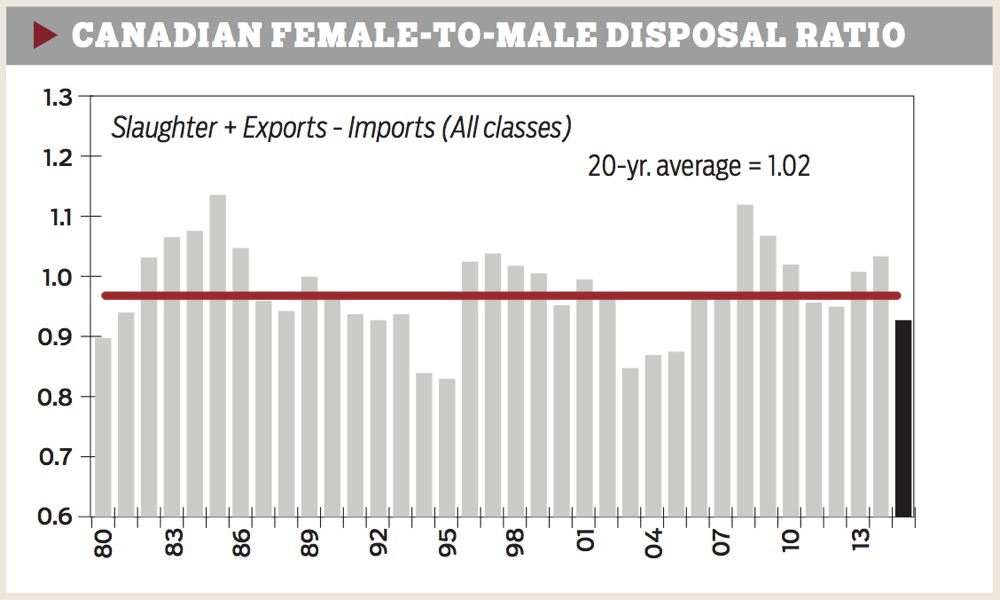

The female-to-male disposal ratio, which measures the number of females (heifers and cows) disposed for every male (steers and bulls), is the best indicator of whether the herd is declining or growing. At 0.96 females being slaughtered for every male in 2015, it is just above previous expansion years when it was 0.94. This may be setting up 2016 as a turn year for the Canadian industry.